A Strong Step by MASAK Towards Financial Transparency and Accountability

Alihan Tuncel, Serhat TümüklüMASAK’s Transparency Initiative on Anti-Money Laundering, Combating the Financing of Terrorism, and Tackling the Informal Economy and Its Impact on Fraud Risks

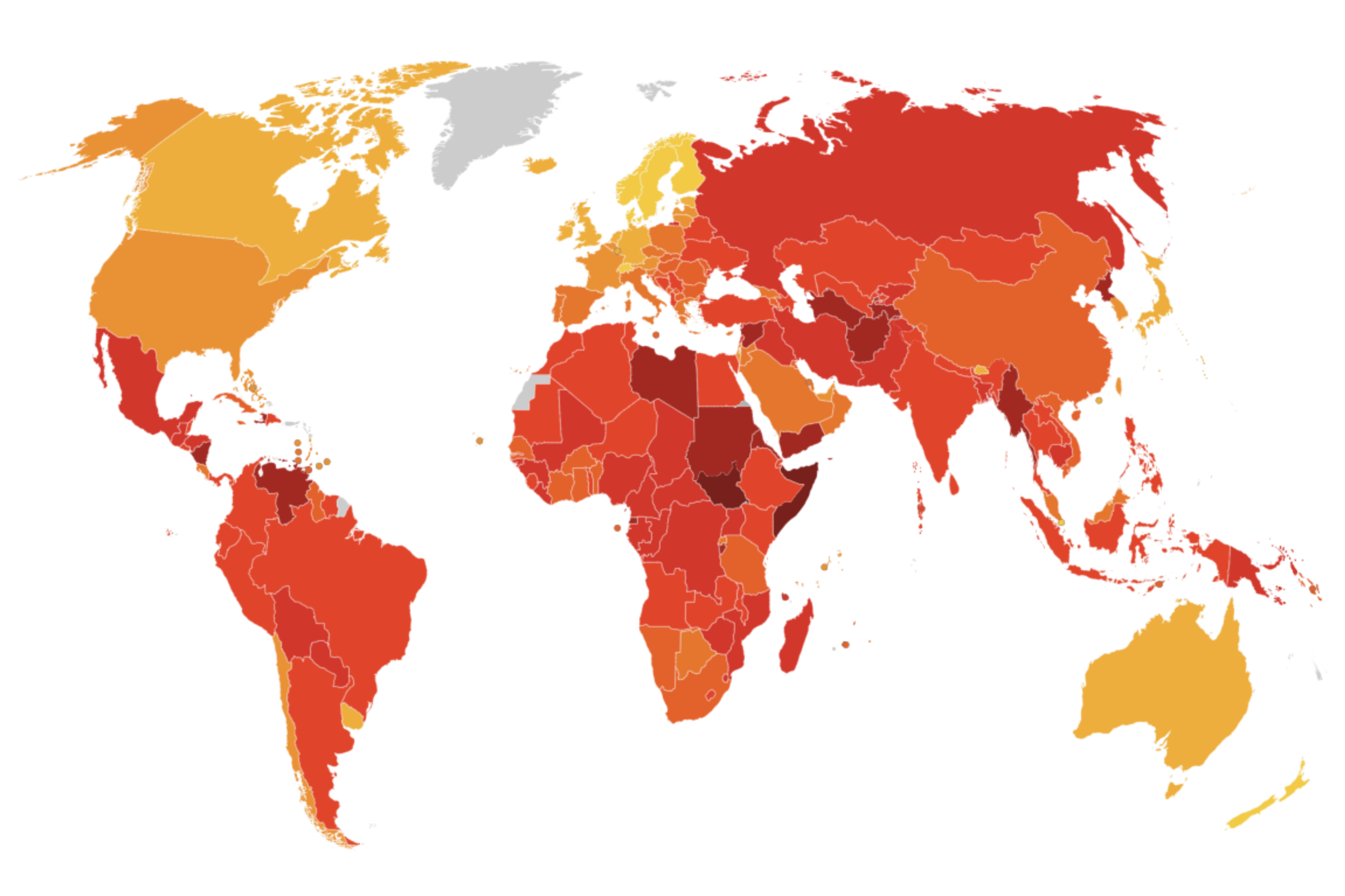

The draft General Communiqué No. 31, published by the Financial Crimes Investigation Board (MASAK) on August 1, 2025, marks a significant step towards enhancing transparency and accountability in the financial system. Issued to strengthen Türkiye’s compliance with the standards of the Financial Action Task Force (FATF) in combating money laundering and the financing of terrorism, and to ensure effective adherence to both national and international obligations, this communiqué directly concerns not only banks and financial institutions but also private sector companies and their exposure to internal fraud risks.

In this article, we examine the new obligations introduced by the communiqué and their potential impact on internal corporate fraud risks.

What Does the Communiqué Bring? Limits, Obligations, and Sanctions

The primary aim of the communiqué is to ensure that the purpose of high-value financial transactions is clearly stated and to prevent unrecorded money flows. Key provisions include:

- For cash and money transfers between TRY 200,000 and TRY 2,000,000, a transaction description is now mandatory, with a minimum of 20 characters.

- For transactions between TRY 2,000,000 and TRY 20,000,000, a Cash Transaction Declaration Form must be completed.

- For transactions exceeding TRY 20,000,000, the declaration form must be accompanied by detailed documentation and justification.

Non-compliance will result in administrative sanctions under Law No. 5549. Furthermore, MASAK reserves the right to request detailed information and documents for any transaction deemed suspicious, regardless of the amount.

The End of Vague Descriptions

The practice of conducting transactions with vague and ambiguous descriptions is coming to an end. In the past, generic terms such as “other” or “personal payment” provided an opportunity to disguise the true nature of transactions, allowing approving or monitoring personnel to proceed without questioning the transaction’s underlying purpose. MASAK’s requirement for specific and substantive descriptions will now prevent individuals / companies from using such evasive expressions, making transaction processes more transparent, traceable, and auditable.

How Will This Affect Internal Corporate Fraud?

The communiqué is not only a strong safeguard against external money laundering activities but also a potential barrier against internal corporate fraud risks. Possible impacts include:

- Narrowing the Scope for Employee Misconduct

A common method in internal fraud schemes is to execute high-value bank transfers without clear or legitimate explanations—often to conceal fictitious supplier payments or illicit commissions. With the new requirement for explicit and detailed justifications, exploiting this method becomes significantly more difficult for employees.

- Enhancing Transparency in Internal Control and Audit Processes

The communiqué’s requirements for meaningful explanations and supporting documentation will strengthen companies’ internal control and audit functions:

Real-Time Monitoring and Proactive Control: Finance and accounting departments will no longer rely solely on amount-based checks; they will assess each transaction’s stated purpose, enabling real-time analysis and early detection of unusual transactions that may otherwise appear routine.

Documentation-Based Auditing: Internal audit teams will review not only accounting entries and bank slips but also transaction declarations and explanations. The Cash Transaction Declaration Forms will become valuable data sources for analyzing fraud risks during audits and investigations, enabling auditors to identify vague explanations or inconsistencies with the company’s business model more quickly.

Clear Responsibility Chains: Each transaction will now have clearly defined responsibilities for finance, accounting, approving managers, and the transaction initiator, reducing the likelihood of unchecked approvals and fostering a culture of accountability.

Technology-Driven Controls: ERP systems will need to incorporate automated checks and alerts, such as blocking transactions with insufficient descriptions or preventing them from proceeding without proper approval. Suspicious transactions could be automatically flagged for review by internal audit.

Anomaly-Based Fraud Detection: Audits will focus on questions such as “Is this transaction normal?” and “Is the explanation adequate?”—shifting towards early anomaly detection, potentially identifying fraudulent activities before or during execution.

3. Stricter Managerial Approval Mechanisms

A significant portion of fraud cases arises from managerial abuse of authority or negligence. The requirement for documented justifications in high-value transactions will make managerial approval processes more transparent and deter potential misconduct.

4. Strengthening the Role of Compliance Departments

Compliance teams will analyze suspicious transactions not only by amount but also by description, frequency, and profile mismatch, enabling faster detection and prevention of potential internal and external fraud risks.

Conclusion: More Than Just a Regulation – An Opportunity

Scheduled to take effect on January 1, 2026, this communiqué does more than impose regulatory obligations; it offers companies an opportunity to ensure financial transparency, detect internal fraud risks at an early stage, and strengthen internal control systems. In particular, the requirement for justification in high-value transactions will make off-the-books activities more visible and shift internal audit and compliance processes toward a proactive model.

However, to transform this opportunity into an effective defense mechanism, companies must:

- Align internal control procedures with the communiqué’s requirements,

- Provide training to employees on declaration requirements and fraud awareness,

- Invest in technological infrastructure to enable real-time transaction monitoring.

MASAK’s transparency-focused initiative represents a critical step in the fight against financial crime. The path to effectively combating such crimes lies in making every transaction visible; every unexplained transaction is a potential fraud risk.

At Cerebra, we stand ready to support organizations in managing fraud risks and enhancing transparency—through compliant process design, strengthened internal control systems, and internal investigation support at every stage.