Rising Corruption Risk in Turkey and Its Implications for the Private Sector

CerebraCPI 2025 indicates Türkiye’s downward trend in perceived corruption continues. This article examines what the decline means for the private sector, focusing on investment and financing costs, competition and market trust, third-party (intermediary/adviser) risks, and reputational exposure.

2025 Corruption Perceptions Index: Turkey’s Recent Trajectory Points to Structural Erosion of Trust

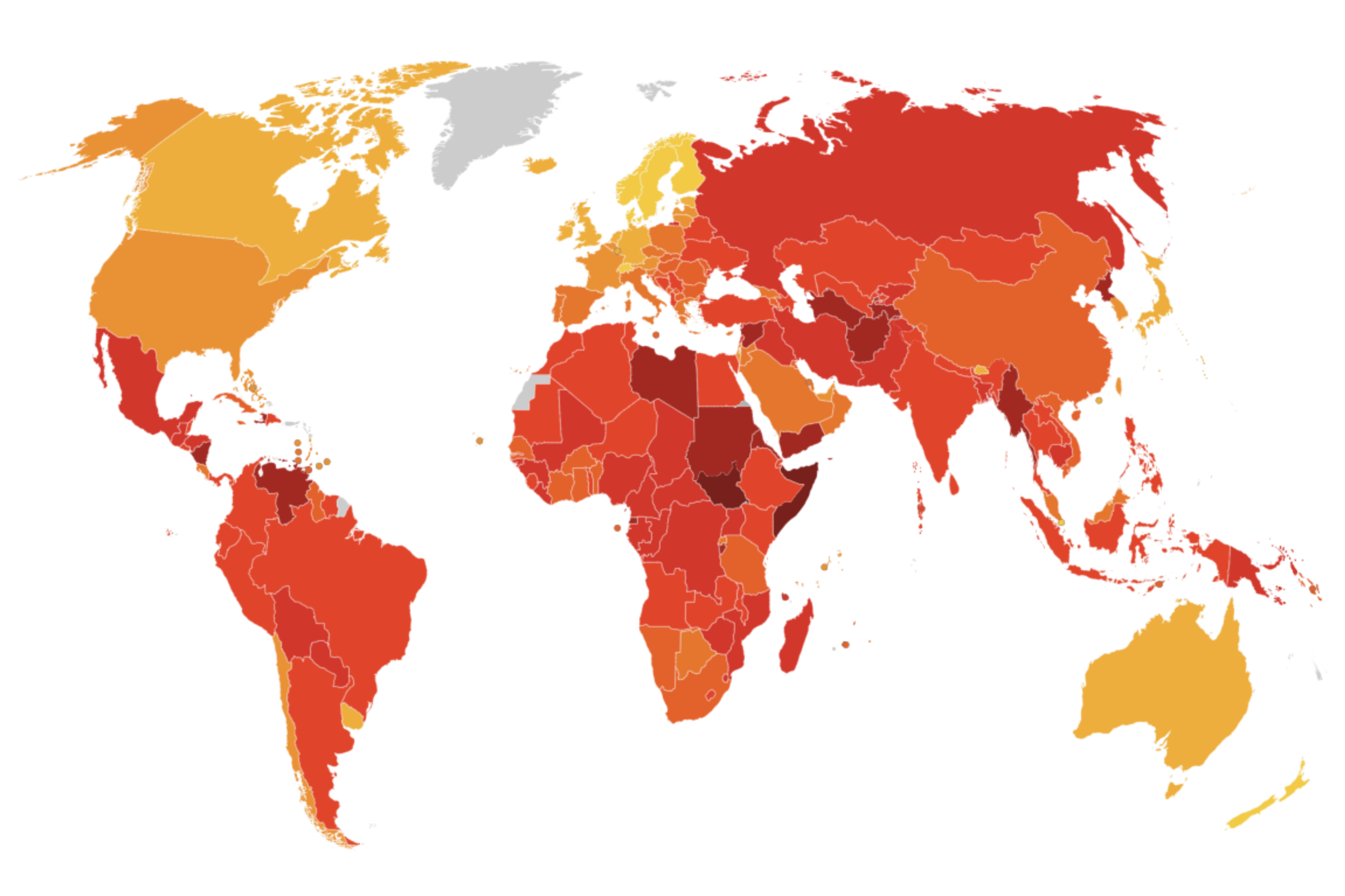

The 2025 results of the Corruption Perceptions Index (CPI), published by Transparency International and measuring perceived corruption in the public sector, have been announced. While Turkey ranked 107th out of 180 countries in 2024 with a score of 34, it fell to 124th in 2025 with a score of 31. The sharp decline in ranking indicates that Turkey’s relative position has weakened in international comparison and that overall risk perceptions have shifted onto a more negative footing.

The longer-term trend makes the picture even clearer. Turkey’s move from being close to the 50-point band in 2013–2015 to being compressed into the 30-point range in recent years points not to temporary fluctuations, but to a structural erosion of trust and reputation.

For this reason, CPI data should not be read merely as a metric about public administration. The deterioration in corruption perceptions is also a direct risk parameter for the private sector—shaping everything from investment decisions and the cost of doing business to competitive dynamics and reputation management.

The Private Sector’s Role in How the Index Is Calculated

The CPI is not a narrow assessment based only on perceptions of public officials. It draws on a range of sources, including assessments by business executives, country risk analysts, international investors, and financial institutions. As a result, the private sector’s on-the-ground observations and experiences directly feed into the end result.

More importantly, a large share of public-sector corruption cases are shaped by a two-sided relationship: even if the recipient is a public official, the payer is often a private-sector actor. This reality shows that the CPI’s decline reflects not only weaknesses on the public side, but also accumulated risks at public–private touchpoints and how those risks manifest in business practices.

Rising Risks for the Private Sector

Turkey’s classification as a high-risk country in terms of corruption perceptions has multidimensional implications for the private sector—simultaneously across legal, operational, and reputational dimensions. For companies operating in Turkey or connected to Turkey, the compliance burden created by foreign anti-corruption frameworks such as the FCPA and the UK Bribery Act becomes more critical; international companies in particular tend to monitor their Turkey operations more closely and apply tighter controls over third-party risks involving intermediaries and consultants.

At the same time, the presence of potential “facilitation” or “expediting” payment demands in sectors that intersect with the public sphere can push companies into difficult ethical and commercial positions—raising the cost of doing business and increasing uncertainty. Non-transparent processes can distort competition and undermine market confidence.

Finally, because the CPI score is a key reference point in country-risk assessments for global investors and business partners, a low score creates a framework that directly affects corporate reputation, the ability to form international partnerships, and the attractiveness of the country (and companies operating within it) to investment.

The Foreign Investor Perspective: A Higher Risk Premium

From a foreign investor’s point of view, corruption perceptions raise fundamental questions such as:

- How effective are legal protection mechanisms?

- Are public processes predictable?

- Are regulations transparent and applied equally?

- What is the level of local partnership and third-party risk?

In countries where corruption perceptions are high, the risk premium rises, financing costs increase, and cautious, short-term approaches tend to be favored over long-term strategic investments.

For this reason, the CPI is not merely a perception indicator—it is also a risk parameter that influences economic decision-making.

What Can the Private Sector Do in Turkey?

Turkey’s CPI position is not a data point the private sector should passively observe. On the contrary, it is a warning signal that requires proactive action.

A Collective Stance

Corruption demands are often sustained through a supply–demand dynamic. If the private sector takes a systematic and collective stance against such demands, their sustainability weakens. Common ethical commitments can be developed through sector associations and business platforms.

-

Strong Ethics and Compliance Programmes

Ethics and compliance programmes are no longer merely procedural requirements—they are strategic risk management tools.

In an environment like Turkey, where corruption perceptions are rising and public-sector interaction is unavoidable in many industries, companies must move beyond simply “having” programmes and ensure they truly function in practice.

An effective programme requires: accurately defining corruption risks through risk-based assessments; establishing robust due diligence processes for third parties such as intermediaries, consultants, and distributors; and putting in place specific, clear, and implementable procedures for all critical touchpoints with the public sector (tenders, licensing and permits, taxation, incentives, customs, etc.).

It also requires managing grey areas such as gifts and hospitality through clear rules, setting up effective whistleblowing mechanisms that employees can use with confidence, maintaining internal investigation capability to respond quickly and rigorously when needed, and—most importantly—ensuring senior leadership unequivocally owns this framework and demonstrates an explicit and firm “tone at the top.”

The worsening CPI picture makes it essential for companies in Turkey to be more careful, more disciplined, and more consistent across each of these elements—because corruption risk is no longer theoretical; it is a reality that directly shapes business practices, costs, and reputation.

-

A Controlled Approach in Areas Intersecting with the Public Sector

Turkey’s CPI position and the current high-risk perception environment reduce the margin for error in processes that intersect with the public sector. Tender processes, licensing and permit applications, and tax and incentive practices are among the areas where fraud and corruption risk is most concentrated because they involve direct interaction with public authority.

Companies should therefore remove key decisions from single-person dependency through dual-approval mechanisms, record every step through mandatory and auditable documentation, and strengthen the control framework by including explicit compliance clauses in contracts with third parties (such as anti-corruption commitments, audit rights, termination clauses, and training and notification obligations). In high-risk jurisdictions, what makes the difference is not “intent,” but a concrete, repeatable, and measurable control discipline at these touchpoints.

Conclusion: A Strategic Warning for the Private Sector

Turkey’s downward trend in recent years is not only an issue for public administration. It directly shapes the private sector’s risk environment as well.

The continuity of corruption demands depends on the supply side—and the supply side is largely the private sector.

Therefore, a significant part of the solution also lies with the private sector.

Through strong ethical infrastructures, a collective stance, and systematic risk management, the private sector can not only reduce its own legal and reputational exposure, but also contribute to improving the country’s overall environment of trust.

The Corruption Perceptions Index is a result. But it is also a call.

And today, that call is more directed at the private sector than ever.